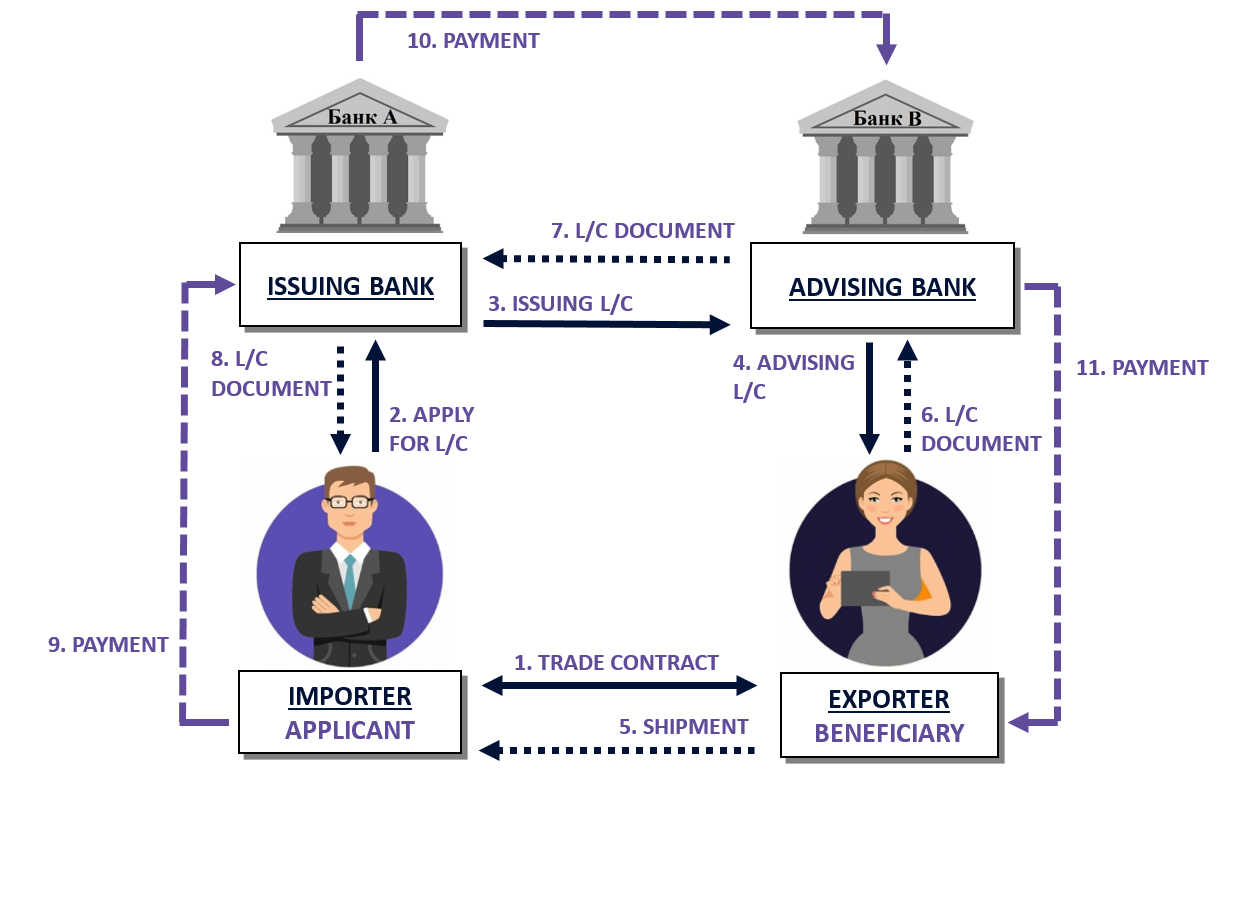

Letter of credit is one of the traditional payment methods that is commonly used in international trade and the most essential advantage is to secure the fulfillment of sales contract obligations of both importer and exporter.

We offer the following services:

When Letter of Credit is used?

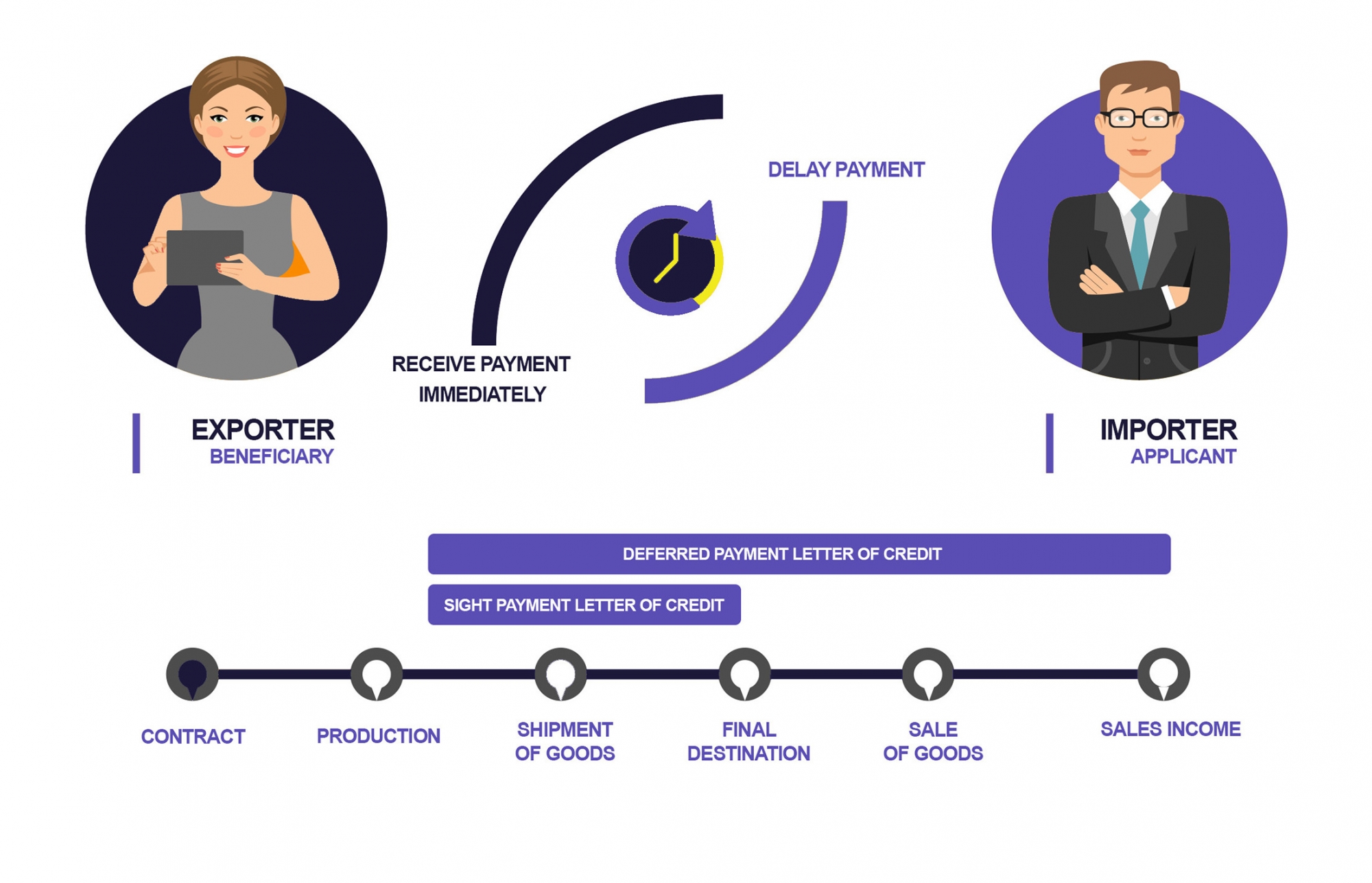

Letter of credit in trade cycle:

Trade contract parties cannot execute the shipment of goods and the payment at one time due to long distance between themselves. Thus these 2 operations confront each other in terms of timing. Letter of credit allows parties oversee their liabilities agreed on the trade contract. Therefore, having this service enables our customers to obtain or negotiate mutually beneficial letter of credit terms and conditions.

| Import letter of credit /lc/ | fees & commissions | |

|---|---|---|

| Issuance of covered LC | 50 USD | |

| Issuance of uncovered LC | Issuance | 0.1% (min 50 USD, max 250 USD) |

| Risk fee | 1%-5% (annual rate) | |

| Per each LC payment | 20 USD | |

| Additional service fees requested by customer: | ||

| Amendment fee | 40 USD | |

| Cancellation | 50 USD | |

| Sending an inquiry | 10 USD | |

Ps: If letter of credit charges and/or costs cannot be collected from the beneficiary, the applicant is liable for such incurred charges. | ||

| EXPORT LETTER OF CREDIT /LC/ | FEES & COMMISSIONS |

|---|---|

| Advising of the LC | 20 USD |

| Examining the documents and demand for payment | 50 USD |

| Additional service fees requested by customer: | |

| Advising of the LC amendment | 10 USD |

| Cancellation | 25 USD |

| Sending an inquiry | 10 USD |

| Ps: Customers are charged for courier services. | |